Virtual Commissioning Market Size to Cross USD 4.86 Billion by 2034

Virtual Commissioning Market Size, Trends and Future Outlook

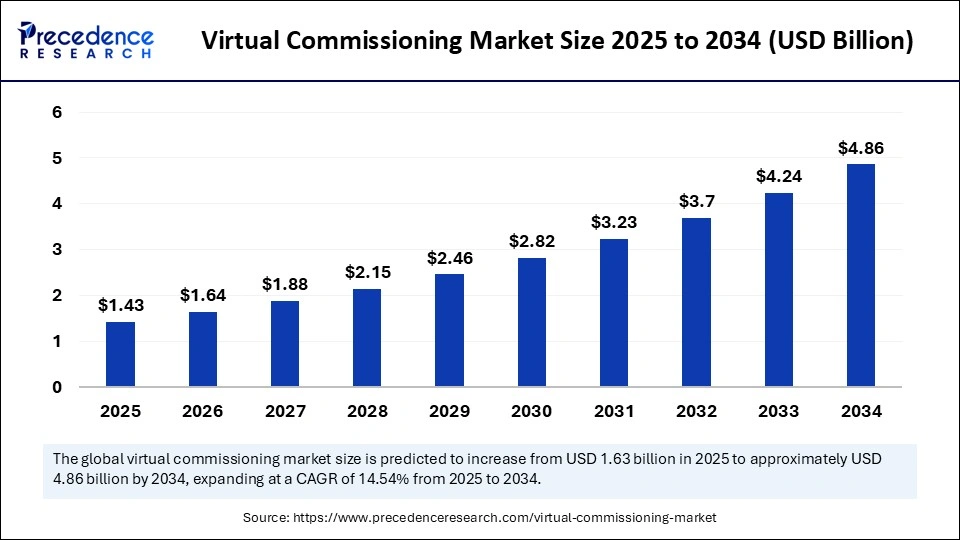

The global virtual commissioning market is set to reach a remarkable USD 4.86 billion by 2034, expanding at a robust CAGR of 14.54% from 2025 to 2034, propelled by the surge in industrial automation and the digitalization of manufacturing workflows.

Simulation Drives a Smarter Industrial Future: North America and Asia Pacific Lead the Way”

Virtual commissioning is reshaping industries as digital twins accelerate automation, slashing costs and downtime. The market is forecast to grow from USD 1.43 billion in 2025 to USD 4.86 billion by 2034. North America holds the revenue crown, while Asia Pacific is the fastest-growing region, powered by smart manufacturing and digital innovation.

With a projected CAGR of 14.54% between 2025 and 2034, virtual commissioning has become central to industrial competitiveness. Automotive, aerospace, and manufacturing leaders are adopting digital twins to streamline operations, shorten time-to-market, and minimize costly errors and downtime. The growth is fueled by demand for efficiency, predictive maintenance, and the relentless march toward Industry 4.0 automation.

Virtual Commissioning Market Key Insights

-

The market size will grow from USD 1.43 billion in 2025 to USD 4.86 billion in 2034.

-

North America is the largest revenue generator.

-

Asia Pacific is the fastest-growing region.

-

Leading segment: Plant & process simulation dominates applications.

-

Top use case: Automotive and transportation sectors lead adoption.

-

On-premise deployment is currently most preferred, but cloud solutions are surging.

-

U.S. market to reach USD 1,547.91 million by 2034.

-

Large enterprises drive adoption, while SMEs become the fastest new adopters.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6810

Virtual Commissioning Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.86 Billion |

| Market Size in 2025 | USD 1.43 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application / End-Use Industry, Deployment / Service Model, Organization Size / End-User Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Artificial intelligence is advancing virtual commissioning by enabling systems to simulate complex, unpredictable scenarios with unprecedented precision. Machine learning models help eliminate human error, improve predictive analysis, and allow for self-adjusting automation during commissioning. As a result, commissioning is now faster and demands fewer resources, pushing the boundary toward adaptive, even autonomous, environments.

AI also bridges the gap between virtual models and real-world execution by enhancing calibration and synchronization. With increased adoption of AI, virtual commissioning platforms are evolving into smart, self-correcting ecosystems that optimize industrial performance.

What Are the Drivers of Virtual Commissioning Market Growth?

Rapid expansion is driven by cost reduction, performance optimization, and the rising complexity of production systems. Smart manufacturing initiatives and workforce shortages in engineering roles amplify the need for digital, simulation-driven automation. Vendors are integrating simulation and control tools and leveraging predictive maintenance for higher uptime.

What Opportunities and Trends Define the Market?

How are digital twins creating new commercial opportunities?

The proliferation of digital twins for predictive maintenance opens fresh avenues for autonomous commissioning, early error detection, and seamless integration with AI systems, particularly as emerging economies ramp up smart manufacturing.

Why does cloud-based deployment matter so much for SMEs?

Cloud solutions slash upfront costs, enable real-time team collaboration, and remove geographic barriers. The subscription pricing model and remote monitoring features democratize access, empowering SMEs to compete with multinationals.

Segmentation and Regional Highlights

-

Application: Plant and process simulation dominates, underpinning everything from automotive to energy and process industries. Robotics & automation simulation is the fastest-growing segment, especially in flexible, high-mix manufacturing.

-

Deployment Model: On-premise platforms remain dominant for security and customization, but cloud solutions are scaling up rapidly, especially for SMEs seeking affordable, flexible innovation.

-

Organization Size: Large enterprises, with their vast resources and operational needs, are the primary market drivers. SMEs, tapping into digital transformation programs, represent the fastest-growing user base.

-

Region: North America leads thanks to its advanced automation ecosystem and smart factory adoption. Asia Pacific’s rise is fueled by industrialization, government support, and an innovation-centric corporate culture.

Virtual Commissioning Market Companies

- Siemens

- Rockwell Automation

- ABB

- Dassault Systèmes

- Visual Components (and Delfoi)

- Maplesoft

- CENIT

- MathWorks

- Beckhoff Automation

- HEITEC AG

- ISG Industrielle Steuerungstechnik

- Robotmaster (Hypertherm)

- ArtiMinds

- OCTOPUZ

- machineering GmbH & Co. KG

- Xcelgo

- RoboDK

- Drag and Bot

- KEB

What Are the Key Challenges and Cost Pressures?

High initial costs for software, hardware, and training continue to present entry barriers, especially for smaller enterprises. Integration with legacy systems is often slow and resource-intensive, while cybersecurity in connected environments remains a concern. These hurdles are gradually giving way to modular solutions and cloud adoption.

Case Study: Automotive Sector Powers Validation

A Tier-1 automotive supplier uses virtual commissioning to validate robotics integration in electric vehicle production. By simulating the entire assembly line before physical deployment, the client reduced commissioning time by 40% and avoided errors that could cost millions in downtime.

Read Also: PDU Power Cords Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344