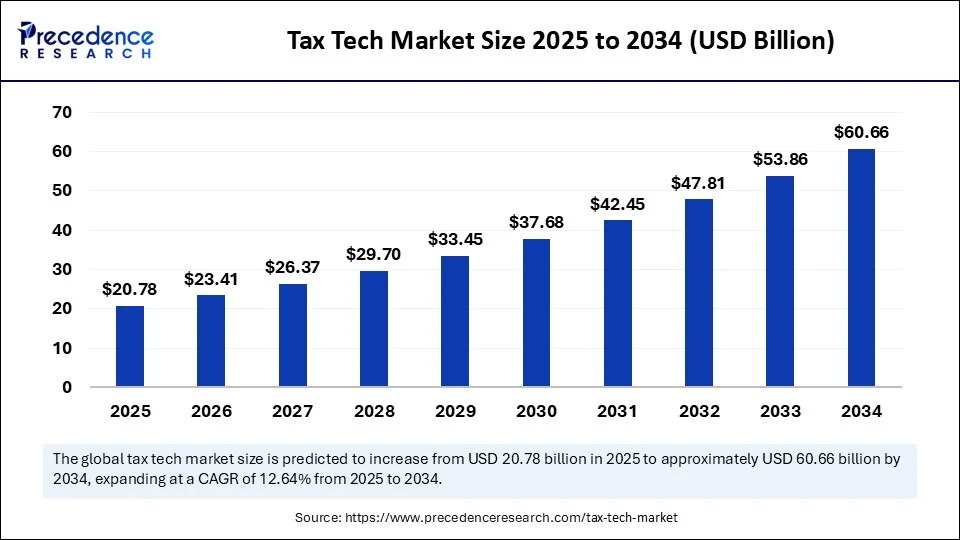

Tax Tech Market Size to Surpass USD 60.66 Billion by 2034

- The global tax tech market was valued at USD 18.45 billion in 2024.

- It is forecasted to reach USD 60.66 billion by 2034, growing at a CAGR of 12.64% from 2025 to 2034.

- North America led the market with the largest share of 39% in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR in the upcoming years.

- By component, software held the largest market share in 2024.

- The services segment is projected to grow at the fastest CAGR during the forecast period.

- By tax type, indirect tax accounted for a considerable share in 2024.

- The property tax segment is expected to grow at a significant CAGR through the studied period.

- By technology, AI and ML dominated the market in 2024.

- The blockchain segment is projected to grow at a notable CAGR over the forecast years.

- By enterprise size, large enterprises captured the highest market share in 2024.

- The SMEs segment is likely to expand at the fastest CAGR going forward.

- By industry vertical, BFSI held the largest share in 2024.

- The Retail & E-commerce sector is expected to grow rapidly during the forecast period.

Role of AI on the Tax Tech Market

Artificial intelligence is revolutionizing tax technology by automating routine processes, enhancing accuracy, and strengthening fraud detection. It enables tax professionals to focus on higher-value strategic tasks by handling complex data analysis and decision-making. AI’s ability to process vast datasets, deliver real-time insights, optimize operations, and apply predictive analytics makes it a powerful tool for improving efficiency, reducing costs, and ensuring regulatory compliance in tax systems. The growing trend of digitalization is accelerating the adoption of AI in tax management solutions. Large enterprises are increasingly integrating AI into their existing systems and software to streamline tax compliance and reporting, thereby enhancing precision and meeting evolving regulatory demands.

A survey report published by the EY Tax and Finance Operations (TFO) in November 2024 finds generative AI (GenAI) will help transform tax and finance functions, helping to address inefficiencies, talent shortages, and compliance with emerging reporting obligations, including those related to global minimum taxes.

Market Overview

The Tax Tech Market is rapidly evolving as digital transformation reshapes the way enterprises manage tax operations. Businesses are adopting advanced tax solutions to reduce complexity, automate compliance, and navigate the ever-changing tax regulatory environment. With traditional tax systems struggling to keep pace with globalization and digitalization, the Tax Tech Market has emerged as a strategic solution offering greater control, transparency, and efficiency. From multinational corporations to mid-sized enterprises, organizations are leveraging technology to handle tax filings, manage cross-border tax implications, and support real-time decision-making. This growing reliance on intelligent tax platforms reflects a broader trend toward integrated financial operations that align with digital-first strategies.

Drivers

Several key factors are driving growth in the Tax Tech Market. One of the foremost is the digitalization of tax authorities, which has led to the implementation of e-filing mandates, digital tax audits, and real-time reporting systems. As tax agencies across the world adopt digital frameworks, enterprises must keep pace by integrating compatible tax technologies. The push for enhanced transparency and accountability, along with growing regulatory pressure, is compelling organizations to invest in modern tax solutions. Furthermore, the increasing reliance on data analytics and real-time financial intelligence has made automation an essential part of tax operations. The shift to cloud platforms, combined with improved cybersecurity protocols, has also lowered the barriers to adoption, especially among large enterprises.

Opportunities

The future of the Tax Tech Market holds immense promise. One of the most exciting opportunities lies in the use of AI and machine learning to create self-learning tax systems capable of real-time monitoring and adaptive compliance. As digital ecosystems expand, there is a growing need for tax technology solutions that integrate seamlessly with ERP, accounting, and financial systems. The demand for mobile-enabled platforms and intelligent dashboards is increasing, particularly in regions where businesses rely on on-the-go financial oversight. Additionally, as sustainability reporting becomes a global requirement, tax solutions that align with carbon pricing and ESG frameworks will gain momentum. Industry-specific tax tech solutions—tailored for sectors like healthcare, construction, and logistics—are also opening up new niche markets.

Challenges

Even with strong growth, the Tax Tech Market is not without challenges. One significant hurdle is the complexity of harmonizing global tax systems within a single platform, especially for multinational corporations dealing with varied tax regimes. Ensuring continuous compliance across jurisdictions while minimizing tax exposure remains a daunting task. Resistance to change from internal finance teams, concerns over data security, and high initial setup costs are additional obstacles. Integration with legacy systems poses a technological challenge, particularly for companies that still rely on outdated financial software. Moreover, constant updates to tax codes require software vendors to be agile and proactive, which adds pressure on both solution providers and end users.

(Also Visit@ https://www.precedenceresearch.com)

Regional Insights

North America continues to lead the Tax Tech Market, with the U.S. and Canada experiencing high adoption rates of AI-powered tax solutions. The regulatory environment in these regions favors digital compliance, driving demand for tax automation. In Europe, government mandates such as MTD in the UK and electronic VAT in Eastern European countries have created a fertile ground for tax technology adoption. The Asia-Pacific region is witnessing exponential growth as digital infrastructure improves and governments introduce e-invoicing and real-time compliance frameworks. Countries like Japan, India, and Australia are leading the charge, supported by increasing investments in fintech. The Middle East and Africa are gradually embracing tax tech, especially among oil, gas, and financial service industries seeking operational efficiency.

Recent Developments

Recent trends in the Tax Tech Market highlight the shift toward AI-driven compliance automation and predictive analytics. Leading companies have launched platforms that use natural language processing (NLP) to interpret regulatory changes in real time. Cloud-native tax engines are gaining popularity, enabling enterprises to centralize their tax data and ensure consistency across departments. Acquisitions and strategic mergers have also shaped the competitive landscape, allowing companies to expand their capabilities and geographic reach. Some vendors have developed real-time APIs that plug directly into government tax portals, ensuring compliance without manual intervention. Continued innovation in areas such as blockchain and digital identity verification is also expected to transform the market in the years ahead.

Tax Tech Market Companies

- Ernst & Young Global Limited

- Consulting Services LLP

- Vertex Inc.

- Avalara, Inc.

- KPMG Assurance

- Transfer Pricing Associates BV

- Grant Thornton Advisors LLC

- Deloitte Touche Tohmatsu Limited

- SAP SE

- Wolters Kluwer N.V.

- Thomson Reuters

- Sovos Compliance

- Xero Limited

- TaxJar

Segments Covered in the Report

By Component

- Software

- Tax Compliance Software

- Tax Planning and Management Software

- Others

- Services

- Implementation Services

- Support and Maintenance

- Others

By Tax Type

- Direct Tax

- Indirect Tax

- Property Tax

- Payroll Tax

- Others

By Technology

- Robotic Process Automation (RPA)

- Big Data and Analytics

- Natural Language Processing (NLP)

- Blockchain

- Artificial Intelligence (AI) and Machine Learning (ML)

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Industry Vertical

- Pharmaceutical & Healthcare

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Retail & E-commerce

- Oil & Gas

- Manufacturing

- Government

- Others

By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Get Sample Link@ https://www.precedenceresearch.com/sample/6293