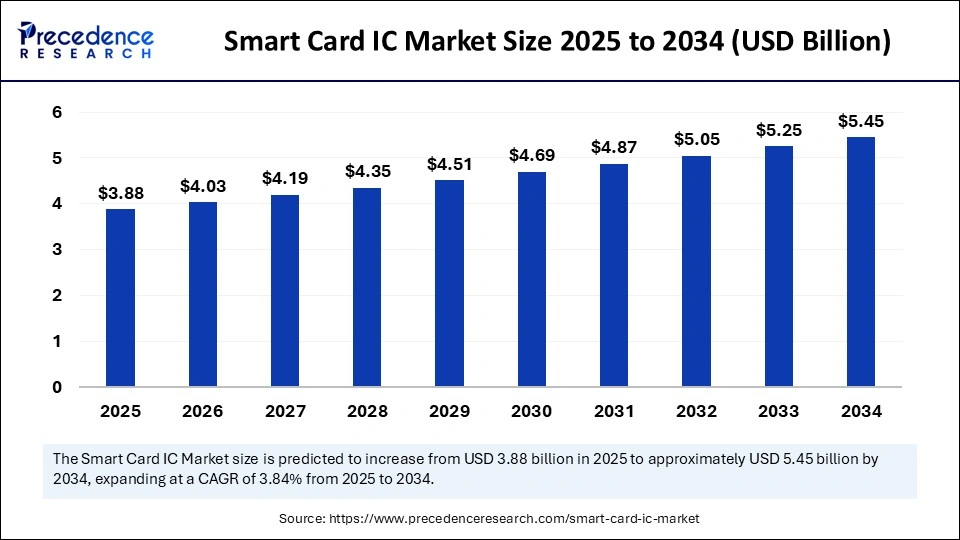

Smart Card IC Market Size to Hit USD 5.45 Billion by 2034

The global smart card IC market size is estimated to hit around USD 5.45 billion by 2034 increasing from USD 3.74 billion in 2024, with a CAGR of 3.84%.

Smart Card IC Market Key Takeaways

- In terms of revenue, the smart card IC market is valued at $3.88 billion in 2025.

- It is projected to reach $5.45 billion by 2034.

- The market is expected to grow at a CAGR of 3.84% from 2025 to 2034.

- Asia Pacific dominated the global smart card IC market with the largest revenue share in 2024.

- North America is expected to grow at the fastest CAGR from 2025 to 2034.

- By type, the contactless segment held the major revenue share in 2024.

- By type, the contact segment is expected to grow at the highest CAGR during the projection period.

- By architecture, the 16-bit segment dominated the market in 2024.

- By architecture, the 32-bit segment is expected to expand at the fastest CAGR between 2025 and 2034.

- By configuration, the microprocessor-based cards segment contributed the biggest market revenue share in 2024.

- By configuration, the hybrid smart cards segment is expected to expand at a significant CAGR in the coming years.

- By application, the ID cards segment contributed the biggest revenue share in 2024.

- By end-user, the government segment dominated the market in 2024.

- By end-user, the healthcare segment is expected to grow at a significant CAGR over the projected period.

AI Impact on the Smart Card IC Market

-

AI‑enabled smart cards are raising the bar in authentication and transaction security by embedding intelligent encryption and anomaly detection right within the chip

-

By predicting hardware issues before they occur, AI helps reduce disruptions and keeps systems running smoothly in high-stakes environments

-

With features like biometric templates and adaptive logic stored in‑chip, AI smart cards are offering highly personalized and user‑friendly security experiences.

Market Overview

From roughly USD 3 billion in 2024, the Smart Card IC market is expected to grow at approximately 6–7 percent CAGR through 2029–2034, reaching USD 5–6.5 billion. The product landscape includes contact, contactless, dual interface, and both memory‑only and microprocessor-based ICs. Geography‑wise, Asia Pacific leads with over one‑third of market share, followed by North America and Europe. Usage spans telecom SIM cards, financial cards, government IDs, transportation, healthcare, enterprise identity, and more.

Drivers

-

Asia Pacific leads growth thanks to rapid e‑commerce, transit smart card deployment, and digital ID programs in nations like China and India.

-

Telecom operators are upgrading from traditional USIM to eSIM infrastructure, embedded directly into devices—driving secure IC requirement globally.

-

Governments across regions—and particularly in Europe and Latin America—are rolling out e‑passport, voter ID and citizen identification systems that rely on secure smart card ICs.

-

The BFSI sector continues migration to EMV standards globally, requiring smart card IC upgrades in new issuance cycles.

-

Rapid digitization in healthcare and transport is fueling deployment in access control, fare collection, and patient data security.

Opportunities

-

Regional customization: cost‑effective low‑end memory ICs for transit ticketing or access cards in emerging economies.

-

Targeted high‑security ICs for European and US government sectors or large enterprise applications.

-

Telecom‑driven growth: eSIM provisioning and subscriber authentication for 5G devices.

-

Biometric smart card solutions for secure access, travel and vault access.

-

IoT module integration—with ICs embedded into devices or wearables for device identity, encryption, and data protection.

Challenges

-

Price sensitivity remains a barrier in emerging regions; premium secure ICs may be financially out of reach without scale and subsidies.

-

Fragmented regulations and varying data security standards across countries complicate global rollout strategies.

-

Cybersecurity vulnerabilities—basic standards may be bypassed via side‑channel or protocol attacks—raise trust concerns.

-

Increasing digital wallet adoption may reduce demand for physical contactless cards in markets like North America.

-

Supply chain volatility—raw material and semiconductor shortages—erode production reliability.

Recent Developments

-

Asia Pacific regions have launched large‑scale digital ID and transit fare card rollouts using contactless ICs.

-

Key IC vendors have collaborated with telecom providers to support eSIM platforms in IoT and smartphone markets.

-

Government adoption of biometric-enabled smart cards—including fingerprint or iris-based ID credentials—has accelerated across Europe and Asia.

-

Financial institutions have begun issuing dual‑interface and biometric cards for both payments and secure authentication use.

-

Industry consortia have adopted new interoperability standards—covering secure element management, remote app provisioning, and cross-application compatibility.

Smart Card IC Market Companies

- Infineon Technologies

- NXP Semiconductors

- STMicroelectronics

- Samsung Electronics

- IDEMIA

- Giesecke+Devrient

- Microchip Technology

- Texas Instruments

- Toshiba Corporation.

- Nations Technologies Inc.

Get Sample Link @ https://www.precedenceresearch.com/sample/6205

Segment Covered in the Report

By Type

- Contact

- Contactless

By Architecture

- 16-bit

- 32-bit

By Configuration

- Memory Cards

- Microprocessor-based Cards

- Dual-interface Cards

- Hybrid Smart Cards

By Application

- SIM Cards

- ID Cards

- Employee IDs

- Citizen IDs

- ePassports

- Driving Licenses

- Financial Cards

- IoT Devices

- Others

By End-user

- IT & Telecommunications

- BFSI

- Government

- Healthcare

- Transportation

- Retail

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Also Read @https://www.precedenceresearch.com