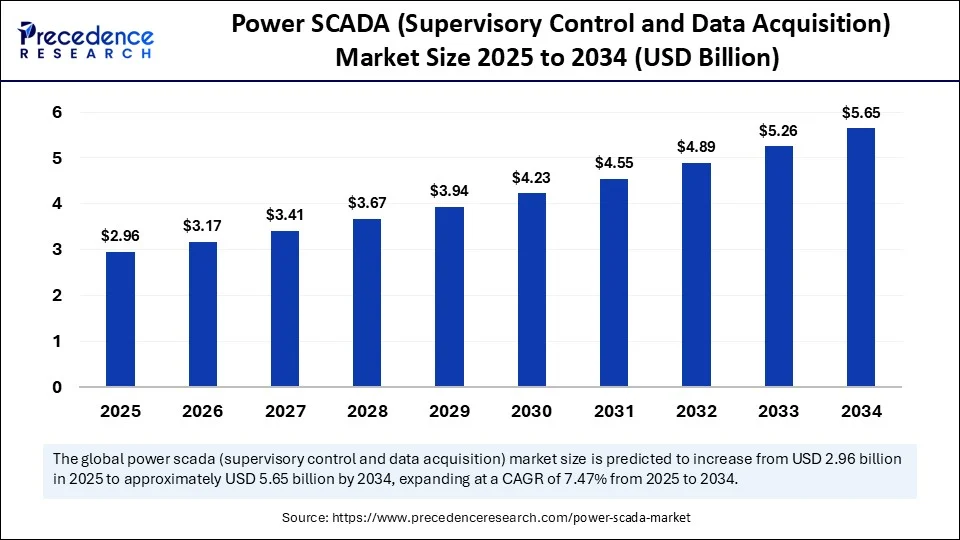

Power SCADA Market Size to Surpass to USD 5.65 Billion by 2034

The global power SCADA market size is calculated to reach around USD 5.65 billion by 2034 from USD 2.75 billion in 2024, with a CAGR of 7.47%

Power SCADA (Supervisory Control and Data Acquisition) Market Key Takeaways

- In terms of revenue, the global power SCADA (Supervisory Control and Data Acquisition) market was valued at USD 2.75 billion in 2024.

- It is projected to reach USD 5.65 billion by 2034.

- The market is expected to grow at a CAGR of 7.47% from 2025 to 2034.

- North America dominated the power SCADA (Supervisory Control and Data Acquisition) market with the largest market share of 42% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the upcoming years.

- By component, the hardware segment held the biggest share in 2024.

- By component, the software segment is observed to grow at the fastest CAGR during the forecast period.

- By architecture, the open system architecture (OSA) segment generated the highest market share in 2024.

- By architecture, the closed system architecture segment is expected to grow at the fastest CAGR in the coming years.

- By deployment model, the on-premises segment captured the highest market share in 2024.

- By deployment model, the cloud-based is emerging as the fastest growing segment during the forecast period.

- By end-use industry, the power generation segment generated the major market share in 2024.

- By end-use industry, the non-renewables segment is emerging as the fastest growing.

How does artificial intelligence enhance operational efficiency of power SCADA systems?

AI plays a pivotal role in elevating the performance of power SCADA systems by providing real-time analytics, predictive maintenance, and intelligent operational control. Through AI-led analysis of SCADA data, operators can identify emerging inefficiencies, detect anomalies early, and reduce energy losses, leading to optimal load management and pre-emptive equipment failure prediction.

AI also enables automated control changes and adaptive forecasting of demand, strengthening system reliability and responsiveness. Ultimately, AI integration transforms SCADA into a high-functioning, autonomous platform that maximizes efficiency and cuts costs while minimizing manual intervention

Market Overview

The Power SCADA market serves as the backbone of modern electric utility infrastructure, enabling centralized control, telemetry, and automation of generation, transmission and distribution systems. Core components include field interface units (RTUs, PLCs), communication networks, control center software, HMIs, security layers, and integration services. SCADA provides electric utilities with the ability to monitor load conditions, detect failures, orchestrate grid responses, manage DER assets and support decision-making through advanced analytics.

As digital transformation accelerates, traditional SCADA solutions are giving way to interoperable, cloud-ready, AI‑enhanced platforms designed for growing complexity in grid operations and renewable integration.

Key Drivers

-

Grid resilience and modernization: Utilities facing aging infrastructure and increasing outage risk seek to upgrade systems using SCADA to improve reliability, fault diagnostics, automation, and recovery.

-

Renewable energy proliferation: Managing variable solar and wind generation and coordinating energy storage requires SCADA systems capable of real‑time visibility and automated control of DER assets.

-

Industry 4.0 and smart grid digitalization: Integration of SCADA with IoT sensors, big data processing, and predictive analytics enables utilities to optimize operations, reduce maintenance costs, and improve energy utilization.

-

Cybersecurity and regulatory demands: Heightened focus on SCADA system security, diversity of threats and regulations pushes adoption of secure protocols, encryption, logging, segmentation and intrusion detection frameworks.

-

Rising electricity demand: Accelerated adoption of electrification—EVs, AI data center loads, industrial electrification—means utilities must adopt SCADA tools for scalable, efficient power distribution.

Opportunities

-

Next‑generation architecture adoption: Vendors offering open systems architecture, cloud support, modular protocols and microservice‑based SCADA platforms can gain an edge.

-

AI‑driven operations: Embedding machine learning models for predictive maintenance, dynamic load forecasting, anomaly detection, and intelligent automation positions SCADA as a core asset optimization tool.

-

Emerging region expansion: Asia Pacific stands out for rapid urbanization and grid expansion in India, China, Southeast Asia; powered by smart grid policy and rural electrification, these regions offer substantial growth potential.

-

Integration with DER and microgrids: SCADA systems tailored for distributed control of microgrids allow utilities and independent operators to manage assets across decentralized networks.

-

Managed services and cybersecurity packages: Utilities may favor SCADA vendors offering full-stack security monitoring, compliance services and training bundled with SCADA platforms.

Challenges

-

High implementation cost barrier: Purchase of hardware, software licensing, field equipment, installation and skilled labor present significant upfront capital barrier.

-

Legacy system interoperability: Many utilities operate legacy or proprietary systems, demanding careful integration and custom bridging solutions when introducing next‑gen SCADA.

-

Cyber exposure and protocol weaknesses: SCADA protocols like DNP3, IEC 61850 and Modbus may have insecure legacy implementations; modern systems must mitigate this with layered security and intrusion detection mechanisms.

-

Talent and skill limitations: The intersection of IT and OT in modern SCADA requires personnel skilled in cybersecurity, industrial protocols, cloud architecture and analytics, a combination often scarce.

-

Complex regulatory landscape: Different jurisdictions impose different compliance mandates around cybersecurity, cloud data governance, vendor certification and system standards, complicating global deployment.

Recent Developments

-

Platform modernizations by top vendors: ABB’s integration of its OmniCore automation platform with AI‑enabled SCADA in May 2025 significantly enhances real‑time grid insight and fault response. Schneider Electric’s EcoStruxure SCADA upgrade in April 2025 brought advanced cybersecurity, predictive maintenance and better renewables support. Siemens’ March 2025 MindSphere enhancement expanded IoT data integration and analytics for smarter grid scaling in Asia and North America. Honeywell’s early‑2025 Experion SCADA launch includes cloud-native deployment, enhanced dashboards and predictive analytics capability.

-

Regional deployment surges: North America maintains a dominant share (~42%) of the Power SCADA market, driven by strong infrastructure investment, stringent regulation, and vendor presence. Asia Pacific is the fastest-growing region with robust smart grid, substation automation and DER integration rollout.

-

Transition from hardware-centric to software-led models: While hardware still leads in revenue, software and services segments are growing most rapidly—especially cloud-based SCADA, AI analytics and managed service models.

-

Security and zero‑trust adoption: Vendors now include layered security strategies—segmentation, encryption, multifactor authentication, anomaly detection—to meet tightening regulatory and cyber‑resilience requirements.

-

Standards and interoperability advances: Adoption of standards like IEC 61850 and the growth of open architecture platforms help streamline integration, support smart grid deployment and future‑proof SCADA rollouts.

Power SCADA Market Companies

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- General Electric Company

- Emerson Electric Co.

- Eaton Corporation plc

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Hitachi Energy

- Toshiba Corporation

- Yokogawa Electric Corporation

- Larsen & Toubro Limited

- Open Systems International (OSI)

- Indra Sistemas S.A.

- ETAP (Operation Technology Inc.)

- ZIV Automation

- Ingeteam

- SCADAfence

- Advantech Co., Ltd.

Segments Covered in the Report

By Component

- Hardware

- RTU (Remote Terminal Unit)

- PLC (Programmable Logic Controller)

- HMI (Human-Machine Interface)

- Communication Systems

- Other Control Units

- Software

- Real-Time Monitoring Software

- Energy Management Systems

- Automation and Control Software

- Services

- Consulting

- Integration & Implementation

- Support & Maintenance

- Training & Education

By Architecture

- Open System Architecture (OSA)

- Closed System Architecture

By Deployment Model

- On-Premises

- Cloud-Based

- Hybrid

By End-Use Industry

- Power Generation

- Renewable Power Plants (Solar, Wind, Hydro)

- Non-Renewable (Coal, Nuclear, Gas)

- Transmission

- Distribution

- Oil & Gas

- Utilities

- Metals & Mining

- Transportation

- Manufacturing

- Others (Commercial, Data Centers, etc.)

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Also Read@ https://www.precedenceresearch.com