Interactive Fitness Market Size to Reach USD 13.09 Billion by 2034

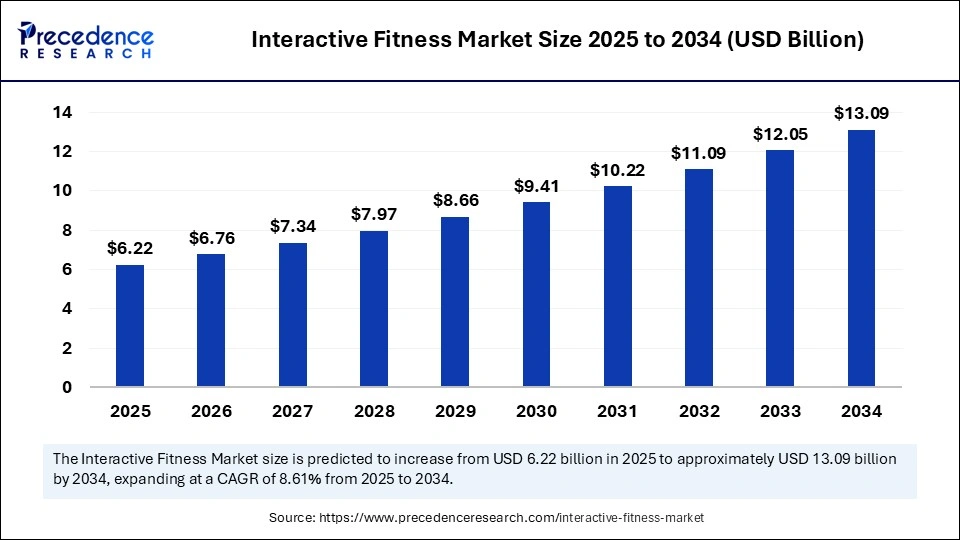

The global interactive fitness market size is valued to reach around USD 13.09 billion by 2034 increasing from USD 5.73 billion in 2024, with a CAGR of 8. 61%.

Interactive Fitness Market Key Takeaways

- In terms of revenue, the interactive fitness market is valued at $6.22 billion in 2025.

- It is projected to reach $13.09 billion by 2034.

- The market is expected to grow at a CAGR of 8.61% from 2025 to 2034.

- North America dominated the interactive fitness market with the largest revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By product, the fitness equipment segment held the major revenue share of the market in 2024.

- By product, the software system segment is expected to grow at the highest CAGR during the forecast period.

- By application, the household segment contributed the biggest revenue share in 2024.

- By application, the gym segment is expected to expand at a significant CAGR in the coming years.

- By end-user, the residential segment dominated the market in 2024.

- By end-user, the non-residential segment is expected to register the fastest CAGR over the projection period.

Impact of Artificial Intelligence on the Interactive Fitness Market

- At many gyms, AI tools track your stats—heart rate, motion, effort—in real time so they can craft workouts just for you based on your goals and how you’re performing.

- In fitness apps, machine learning analyzes data such as movement levels and recovery progress to tailor routines that evolve with you.

- These AI-driven approaches help users see faster fitness gains and stay motivated, increasing their long-term commitment.

- With real-time coaching feedback and virtual trainer capabilities, users essentially get guided workouts as if a coach were monitoring them live.

Get Sample Link @https://www.precedenceresearch.com/sample/6203

Market Overview

The interactive fitness market blends smart equipment, connected wearables, and software platforms that deliver workouts enhanced by digital interactivity. Segmented by product (equipment vs software), by application (home vs gym/studio), and geography, it spans a variety of user types—from households to commercial facilities and enterprise wellness programs.

Market Drivers

Key drivers include intensified health awareness—especially as obesity rates climb—and the ongoing shift from traditional brick‑and‑mortar fitness toward home and hybrid digital models. AI and machine learning empower personalization and adaptability.

Younger generations—namely Gen Z and millennials—are spending significantly more on fitness and wellness than older cohorts, driving demand for premium tech‑driven experiences. Social connectivity, gamification, and community engagement amplify retention and motivation. With corporate wellness programs expanding, employers are investing in subscription‑based fitness solutions for employee health benefits.

Opportunities

Fastest growth is expected in Asia Pacific, followed by emerging growth in Latin America and the Middle East. Localized offerings in these markets—affordable devices, regional classes, multilingual AI coaches—can capture new adopters. In developed markets, studios and gyms are integrating connected equipment to enhance in‑facility experiences and retain members.

Software opportunities include cloud‑delivered coaching platforms, AI analytics services, mental‑health integrations, and multi‑modal wellness ecosystems. Developers that offer white‑label SaaS to trainers and gyms can unlock B2B SaaS revenue. Emerging hardware innovations—such as smart sportswear using textile strain sensors—support advanced fitness and rehab use cases.

Challenges

The premium price of hardware and recurring subscription fees limits penetration in cost-sensitive segments. High-tech devices also risk rapid depreciation and require continual upgrades. Data privacy norms vary by region, creating legal complexity around biometric consent.

Interoperability remains weak, with multiple proprietary platforms fragmenting the ecosystem. Many users churn over time due to platform fatigue unless content is consistently refreshed. Finally, macro forces—such as supply chain disruptions or regulatory changes—can hinder scaling across borders.

Recent Developments

Peloton’s 2025 shift toward subscription-led growth has improved profitability and buoyed its connected fitness subscriber base. Immersive AR/VR platforms such as FitXR, Holofit, Sportvida and others have launched new workout experiences.

AI‑powered wearable innovations—like smart garments with embedded sensors and machine‑learning posture analysis—are beginning commercialization. Fitness apps are weaving in mindfulness, meditation, and recovery programming to deliver holistic wellness. Corporate usage of interactive platforms is climbing, with studios and employer wellness programs incorporating livestream classes and challenges.

Interactive Fitness Market Companies

- Axtion Technology LLC

- BowFlex Inc.

- EGYM Inc.

- Evervue USA Inc.

- Motion Fitness LLC

- Nexersys Corp

- Paradigm Health and Wellness Inc.

- Peloton Interactive Inc.

- SMARTfit Inc.

- TECHNOGYM Spa

Segments Covered in the Report

By Product

- Fitness Equipment

- Software System

By Application

- Gym

- Household

By End-User

- Residential

- Non-residential

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Visit @https://www.precedenceresearch.com/