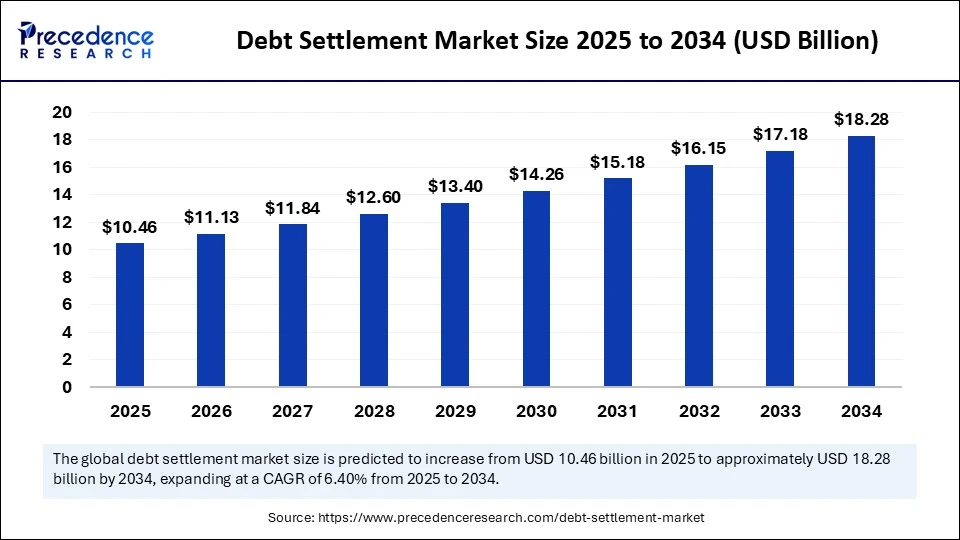

Debt Settlement Market Size to Hit USD 18.28 Billion by 2034

The global debt settlement market size is estimated to hit around USD 18 28 billion by 2034 increasing from USD 9 83 billion in 2024, with a CAGR of 6 40

Debt Settlement Market Key Takeaways

- The global debt settlement market was valued at USD 9.83 billion in 2024 in terms of revenue.

- It is forecasted to reach approximately USD 18.28 billion by 2034.

- The market is projected to grow at a CAGR of 6.40% between 2025 and 2034.

- North America led the market in 2024, accounting for the largest share of total revenue.

- Asia Pacific is anticipated to register a strong CAGR from 2025 to 2034.

- By type, the credit card debt settlement segment dominated in 2024.

- The personal loan debt settlement segment is expected to grow steadily over the forecast period.

- In terms of service type, the debt negotiation segment captured the majority of the market in 2024.

- The debt counselling segment is forecasted to grow consistently between 2025 and 2034.

- Among end users, individual consumers held the largest market share in 2024.

- The SME (small and medium enterprises) segment is likely to grow at a notable CAGR during the forecast period.

- In 2024, offline/traditional distribution channels generated the highest revenue.

- Online/digital platforms are expected to grow significantly at a strong CAGR from 2025 to 2034.

How is AI Impacting on Debt Settlement Solution?

Artificial Intelligence is transforming the debt settlement industry by automating negotiations, accelerating settlements, and offering personalized, data-driven solutions. Traditionally, debt settlement required expert human intervention to guide clients through complex processes. Now, with AI integration, both settlement officers and consumers benefit from increased efficiency and accessibility.

AI-powered data analytics identifies settlement trends, optimal negotiation strategies, and behavioral patterns, enabling faster and more accurate decision-making. The use of AI in standardizing processes is a growing trend, allowing firms to handle high-value, complex tasks with precision. Debt settlement companies are increasingly leveraging AI to deliver 24/7 support, improve client education, and enhance overall user experience.

In April 2025, credit-building platform Kikoff, used by over a million Americans, launched its AI Debt Negotiation tool—a voice AI agent that can negotiate debt on behalf of users. This innovation aims to make debt resolution smarter, simpler, and less stressful for consumers.

Get Sample Link @https://www.precedenceresearch.com/sample/6405

Market Overview

The debt settlement market, primarily serving individual consumers grappling with unsecured debts like credit cards, medical bills, and personal loans, continues to evolve under shifting economic pressures. The market comprises service providers that negotiate with creditors to reduce outstanding debt balances and structure lump-sum payments or streamlined repayment plans.

This sector has grown in response to high household debt levels, stagnant income growth, and rising borrowing costs. In regions where credit card adoption is widespread, market penetration is significant, while in developing economies the sector remains nascent but expanding. Consumer demographic shifts — including growing visibility of shared financial distress during economic slowdowns — have driven recognition and trust in debt settlement solutions.

Drivers

Several forces propel demand in the debt settlement industry. First, escalations in unsecured consumer debt arising from inflation, healthcare costs, and living expenses push more individuals into default risk and financial distress. Second, heightened awareness among consumers that they can negotiate debts — spurred by educational content, media coverage, and word-of-mouth success stories — boosts penetration.

Third, regulatory reforms in many regions allow for structured alternative resolution arrangements, and consumer protection laws governing fair negotiation practices provide platforms with credibility. Fourth, economic downturns and rising interest rates often result in greater numbers of consumers seeking relief via settlement services. Fifth, digital platforms and online actuarial tools have lowered the barrier to entry, enabling more consumers to initiate settlement processes.

Opportunities

The market offers deep opportunity across various fronts. Providers can enhance value by offering integrated advisory services — combining credit counseling, budget coaching, and debt repayment planning alongside settlement negotiations. Expanding into underserved demographic groups—such as gig economy workers or self-employed professionals—who may lack access to traditional consumer credit solutions, opens new customer bases.

There is also room for partnership with fintech lenders, credit unions, and digital banks, enabling preemptive settlement or refinancing offers before delinquency escalates. Another avenue is embedding settlement offerings within broader financial wellness platforms or personal finance apps. In markets where regulatory frameworks permit, scalable B2B arrangements with employers or benefits platforms could deliver debt settlement options as part of financial wellness packages.

Challenges

Despite growth potential, the debt settlement market faces notable headwinds. Public perception of debt settlement remains mixed: some view it as risky or damaging to credit scores, while others have concerns about potential fraud or poor service quality. Regulatory environments vary significantly across jurisdictions, with some governments restricting settlement fees or even banning third-party facilitation.

Legal complexity arises from creditor resistance: many creditors are unwilling to settle or offer unfavorable terms, especially when debtors are not already in default or courts favor formal bankruptcy. Settlement outcomes themselves are unpredictable; reaching agreements often requires substantial negotiation time, and not all creditors participate. Customer trust hinges on transparency and strong service performance, so fraud cases or failed promises can damage reputation. Finally, many providers operate on contingency fees, meaning revenue is contingent on successful settlement—leading to volatility and potential cash flow constraints.

Recent Developments

Recently, several debt settlement firms have adopted hybrid approaches combining digital tools with human negotiation experts. Online platforms now facilitate automated creditor outreach, integrate messaging, and track settlement proposals in real time. Some firms have introduced outcome guarantees—promising minimum reduction levels or alternate arrangements if settlement does not complete as expected.

A trend toward offering modular services is visible: clients can choose stand-alone credit coaching or settlement-only options. In areas with increasing regulatory scrutiny, several providers have proactively adjusted pricing structures, capping fees or offering refund mechanisms to comply with local consumer protection standards.

Partnerships with financial wellness providers and mobile banking platforms have begun to emerge, allowing debt settlement services to be offered as part of broader financial emersion bundles, especially for underserved millennials and low-income households. Digital marketing and educational content campaigns have grown in importance, helping to destigmatize debt solutions and create informed consumer journeys.

Debt Settlement Market Companies

- Freedom Debt Relief

- CuraDebt

- Pacific Debt Inc.

- New Era Debt Solutions

- Accredited Debt Relief

- National Debt Relief

- American Financial Solutions

- Beyond Finance

- CreditAdjusters

- Consolidated Credit Counseling Services

- Alliance Credit Counseling

- DMB Financial LLC

Segment Covered in the Report

By Type

- Credit Card Debt Settlement

- Mortgage Debt Settlement

- Student Loan Debt Settlement

- Medical Debt Settlement

- Personal Loan Debt Settlement

- Others

By Service Type

- Debt Negotiation Services

- Debt Counseling Services

- Debt Management Plans

- Legal Assistance for Debt Settlement

- Others

By End-user

- Individual Consumers

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Distribution Channel

- Online/Digital Platforms

- Offline/Traditional Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Also Read@ https://www.precedenceresearch.com