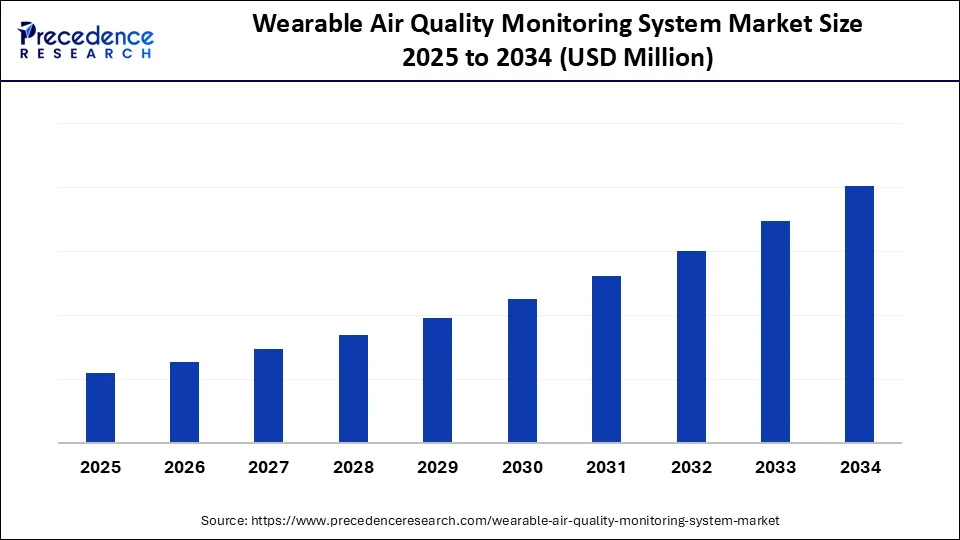

Wearable Air Quality Monitoring System Market Size, Report by 2034

Explore key trends, growth drivers, and forecasts in the wearable air quality monitoring system market from 2025 to 2034. Stay ahead with industry insights.

Wearable Air Quality Monitoring System Market Key Takeaways

- North America held the leading market share in 2024, establishing its dominance across the region.

- Asia Pacific is projected to register the fastest compound annual growth rate (CAGR) from 2025 to 2034.

- Within pollutant types, particulate matter (PM) was the most monitored segment, with PM2.5 accounting for the highest share in 2024.

- The VOCs (Volatile Organic Compounds) segment is forecasted to grow significantly throughout the forecast period.

- Electrochemical sensors emerged as the dominant technology in 2024.

- Hybrid sensor systems are anticipated to expand at a strong CAGR over the forecast timeline.

- In terms of form factor, clip-on devices secured a major portion of the market share in 2024.

- The smart clothing segment is expected to experience the highest CAGR between 2025 and 2034.

- Bluetooth connectivity accounted for the largest share in 2024.

- Cellular technologies (LTE/NB-IoT) are projected to grow rapidly from 2025 to 2034.

- Personal/consumer health monitoring was the top application segment in 2024.

- The industrial worker safety application is likely to show substantial growth in the coming years.

- Consumers were the primary end users in 2024.

- Occupational safety agencies are expected to exhibit rapid market growth through 2034.

- Online retail was the most dominant distribution channel in 2024.

- The B2B sales & contracts channel is forecasted to expand at the fastest rate in the market.

How is AI Altering the Wearable Air Quality Monitoring System Market?

Artificial intelligence is revolutionizing air quality management by enabling precise, real-time data analysis. Machine learning models can process large volumes of sensor data to detect trends, forecast pollution events, and pinpoint sources. This technology supports informed policy decisions and targeted interventions. Additionally, AI can analyze personal data to provide customized recommendations, helping individuals reduce exposure by suggesting alternative routes or activities. These advancements contribute to more effective management strategies, personalized health guidance, and early warning systems.

Market Overview

The enterprise and industrial segment of the wearable air quality monitoring system market is witnessing strong momentum, driven by workplace safety regulations and emerging environmental workplace standards. These wearable badges and portable monitors are increasingly deployed across manufacturing plants, construction sites, laboratories, and smart infrastructure installations.

Compliance regimes require tracking worker exposure to dust, particulate matter, VOCs, and other air contaminants, especially in hazardous environments. Professional users—safety managers, industrial hygienists, and city planners—are adopting these devices to complement fixed monitoring stations by providing dynamic, personal exposure datasets. North America leads in enterprise adoption, but Asia-Pacific, especially China and India, is rapidly growing as large-scale infrastructure and smart city projects demand occupational safety monitoring.

Drivers

Key drivers in this segment include regulatory pressure and occupational safety mandates. Standards like OSHA, EPA, and equivalent regional bodies require companies to monitor personal exposure in certain industries. Another potent driver is the integration of wearable monitors into IoT-enabled safety platforms, providing real-time visibility and alerts on personal exposure levels. Industry stakeholders increasingly view personal exposure data as critical to environmental, social, and governance (ESG) reporting—these insights offer transparent, quantifiable worker health metrics.

Technological advancements—such as Bluetooth-enabled monitors with cloud dashboard integration, long battery life, and rugged hardware—enable practical enterprise usage in challenging environments. Corporations are also investing in employee wellness initiatives, where tracking air quality exposure becomes part of broader health and safety programs.

Opportunities

Enterprise wearables offer expanding opportunities across several verticals. Construction, mining, and heavy industry represent high-value use cases; workers in these environments typically face dust and particulate risks, making continuous monitoring valuable for safety audits. Smart-city programs deploying field personnel, traffic enforcement officers, and sanitation workers can also benefit: collecting granular exposure data across urban areas create crowd-sourced air maps.

Integrations with enterprise safety platforms and dashboards open opportunity for sales of analytics subscriptions and compliance reporting modules. Partnerships with occupational health service providers, insurance companies, and research institutions allow data to be used in epidemiological studies or worker health interventions. There’s also potential to supply wearable AQ solutions as part of bundled safety services in industrial clusters and special economic zones.

Challenges

The enterprise market faces several implementation challenges. Setting up infrastructure—dashboards, data pipelines, calibration services, training—is resource-intensive and can inhibit adoption among smaller firms. Interoperability issues arise when different wearable models and sensor brands produce data in incompatible formats, challenging integration with existing corporate systems.

Accuracy and calibration are critical for regulatory compliance; consumer-grade sensors are often insufficient. Wearables must meet strict performance benchmarks and require periodic validation. There are also data governance and privacy considerations: exposure data tied to individuals can raise legal issues under privacy regulations and labor laws. Finally, cost remains a barrier for large-scale deployment; while enterprise devices tend to be more rugged and accurate, their upfront and operational costs may be prohibitive for budget-sensitive customers.

Recent Developments

Recently, the enterprise wearable AQ market has seen the release of new rugged personal monitors with extended battery life and dust-resistant form factors tailored for field staff in harsh industrial environments. Some new models support real-time Bluetooth data streaming to centralized dashboards, allowing occupational safety managers to receive alerts instantly when exposure thresholds are crossed.

Federated learning prototypes are being piloted in industrial settings, enabling AI models to improve exposure forecasting across devices while keeping each employee’s data local—addressing both privacy and predictive accuracy. Edge-AI implementations now can detect not only pollutant levels but also associate them with activity types (e.g. drilling vs. welding), offering richer context for safety interventions.

Smart city initiatives in several countries are launching pilot programs where wearable badges are provided to municipal field staff to crowdsource air quality maps, enabling city planners to allocate remediation resources more effectively. Finally, some enterprise providers now offer bundled services including calibration, compliance reporting analytics, and training workshops to improve customer retention and lower adoption friction.

Wearable Air Quality Monitoring System Market Companies

- Atmotube (Plume Labs – part of AccuWeather)

- Kaiterra

- TZOA (now part of Awair)

- Aeroqual Ltd.

- Clarity Movement Co.

- Qingping Technology

- Temtop (Elitech Technology, Inc.)

- uHoo

- Sensirion AG

- RAE Systems (a Honeywell company)

- Flow by Plume Labs

- Wavelet Health

- Amphenol Advanced Sensors

- AirBeam (HabitatMap)

- Purelogic Labs India

- Prana Air

- Airveda

- Bosch Sensortec

- Breezometer (acquired by Google)

- Blueair (Unilever)

Segments Covered in the Report

By Pollutant Type Monitored

- Particulate Matter (PM1.0, PM2.5, PM10)

- Volatile Organic Compounds (VOCs)

- Nitrogen Dioxide (NOâ‚‚)

- Carbon Monoxide (CO)

- Ozone (O₃)

- Carbon Dioxide (COâ‚‚)

- Temperature & Humidity Sensors

By Technology

- Electrochemical Sensors

- Optical Particle Counters

- Metal Oxide Semiconductor (MOS) Sensors

- NDIR (Non-Dispersive Infrared) Sensors

- Hybrid Sensor Systems

By Form Factor

- Wristbands

- Clip-on Devices

- Smart Clothing

- Lanyard/Brooch Form

- Helmet/Head-Mounted Devices

By Connectivity

- Bluetooth

- Wi-Fi

- Cellular (LTE/NB-IoT)

- Offline/USB Data Transfer

By Application

- Personal/Consumer Health Monitoring

- Industrial Worker Safety

- Outdoor Activity & Fitness Monitoring

- Healthcare Monitoring (Asthma, COPD)

- Academic & Field Research

By End User

- Consumers

- Occupational Safety Agencies

- Research Institutions

- Healthcare Providers

- Environmental Monitoring Agencies

By Distribution Channel

- Online Retail (DTC platforms, eCommerce)

- Offline Retail (Electronics/Medical Stores)

- B2B Sales & Contracts

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Also Visit@ https://www.precedenceresearch.com