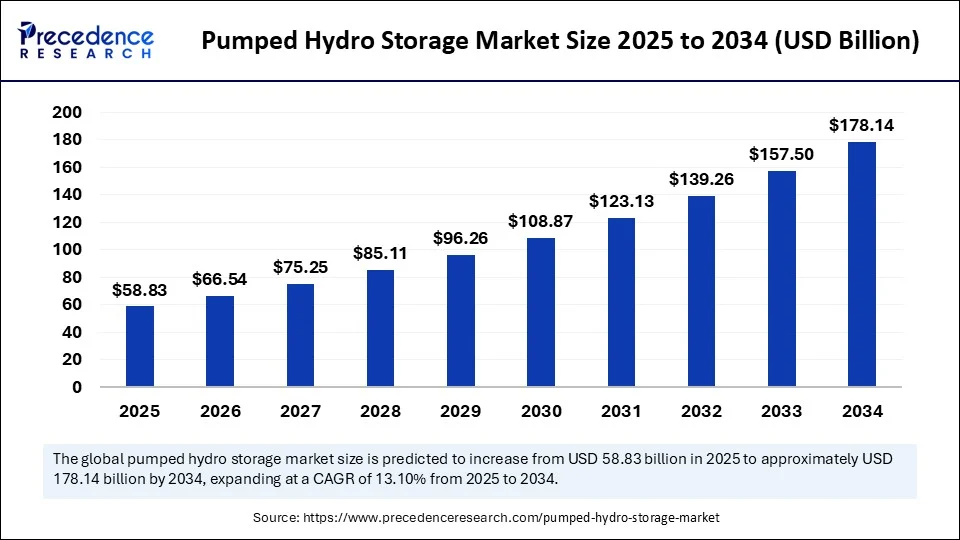

Pumped Hydro Storage Market Size to Surpass USD 178.14 Bn by 2034

Pumped Hydro Storage Market Key Takeaways

- In 2024, the global pumped hydro storage market reached a valuation of USD 52.01 billion.

- The market is forecasted to grow to USD 178.14 billion by 2034.

- It is projected to expand at a CAGR of 13.10% from 2025 to 2034.

- Europe led the market in 2024 with the largest share of 59%.

- The Asia Pacific region is expected to grow at the fastest CAGR between 2025 and 2034.

- North America continues to be a significant contributor to the global pumped hydro storage market.

- By type, open-loop systems captured the largest market share in 2024.

- By type, closed-loop systems are projected to record the fastest CAGR during the forecast period.

- By capacity, the above 1000 MW segment held the dominant market share in 2024.

- By capacity, the 500–1000 MW segment is expected to experience the fastest CAGR in the coming years.

How is Artificial Intelligence Transforming the Operations of Pumped Hydro Storage Systems?

Artificial Intelligence is revolutionizing the operations of pumped hydro storage systems by enabling smarter, more efficient, and predictive energy management. Through advanced algorithms and machine learning models, AI optimizes water flow, turbine speed, and energy dispatch based on real-time grid demand and weather forecasts. AI also enhances predictive maintenance by analyzing sensor data to detect early signs of wear and tear, reducing downtime and extending equipment life. In addition, AI-powered digital twins allow operators to simulate and optimize different operational scenarios without affecting real systems. By integrating AI, PHS facilities are becoming more responsive, cost-efficient, and reliable, especially as they increasingly support intermittent renewable energy sources like solar and wind.

Market Overview

The pumped hydro storage market has become a cornerstone of modern energy strategy, supporting the global shift toward cleaner, more resilient power systems. Pumped hydro is a well-established method of storing electricity by using surplus energy to pump water to a higher elevation and releasing it during peak demand to generate power. As nations focus on energy transition, the pumped hydro storage market has gained traction due to its reliability, scalability, and ability to complement renewable sources. Its role in enhancing energy security, stabilizing the grid, and enabling decarbonization continues to drive attention and investment.

Drivers

A key driver of the pumped hydro storage market is the increasing need for energy grid flexibility. As intermittent renewable energy sources like wind and solar continue to penetrate the grid, there is an urgent requirement for long-duration storage solutions that can manage load variability. Pumped hydro offers an ideal solution by providing large storage capacity and fast response time. Policy incentives, carbon neutrality targets, and global agreements such as the Paris Accord are encouraging governments to prioritize pumped hydro as a foundational energy storage method, thus propelling market growth.

Opportunities

Opportunities in the pumped hydro storage market are abundant, particularly with the rise of hybrid renewable systems. Integrating pumped hydro with solar PV or wind farms creates a stable and reliable energy ecosystem. Regions with mountainous terrain and access to water resources present high potential for new installations. Additionally, advancements in environmental design and underground reservoir development are helping to mitigate ecological concerns, expanding the market’s reach. The growing focus on decarbonizing industrial processes and electrifying transportation sectors will further create demand for grid-supporting infrastructure like pumped hydro.

Challenges

The pumped hydro storage market, while growing, must contend with several challenges. Environmental impact assessments can be lengthy and complex, slowing down project timelines. Land acquisition, water use regulations, and ecological preservation issues often complicate site selection. Furthermore, the need for substantial capital investment and skilled engineering resources can deter new entrants. In areas with limited topographical variation, the pumped hydro model may not be feasible, restricting its adoption. Overcoming these limitations will be essential for unlocking the full potential of the pumped hydro storage market.

Regional Insights

Europe’s leadership in the pumped hydro storage market is supported by mature energy infrastructure and a strong commitment to sustainability. With 59% of the global market share in 2024, Europe remains at the forefront of energy storage deployment. Asia Pacific is poised to experience the highest growth rate from 2025 to 2034, supported by rapid urbanization, rising electricity consumption, and ambitious clean energy goals. North America continues to play a significant role, with investment directed at modernizing the grid and improving resilience against extreme weather events. Each region’s strategic energy focus influences the evolution of the pumped hydro storage market.

Pumped Hydro Storage Market Companies

- ANDRITZ AG (Austria)

- Siemens AG (Germany)

- Enel SpA (Italy)

- Duke Energy Co. (U.S.)

- Voith GmbH & Co. KGaA (Germany)

- GE Vernova (U.S.)

- Power Construction Corporation of China (China)

- Torrent Power (India)

- ITC Holdings (U.S.)

- NextEra Energy, Inc. (U.S.)

- China Energy Engineering Corporation (China)

Recent Developments

In the pumped hydro storage market, recent developments focus on accelerating project approval timelines and reducing environmental impacts. Engineering innovations such as variable-speed turbine generators and pumped thermal energy storage alternatives are expanding application versatility. Public-private partnerships are playing a bigger role in project financing and implementation. Governments are also increasing support through subsidies and tax incentives, encouraging utilities and developers to invest in pumped hydro solutions. As energy demand grows and clean energy adoption intensifies, the market continues to evolve rapidly.

- In May 2025, AGL acquired 100% ownership of two pumped hydro energy storage projects held by Upper Hunter Hydro Top Trust and its trustee (UHH). The two early-stage projects are located in the Hunter region, NSW. The projects at Glenbawn and Glennies Creek aim to provide 770 MW 10-hour and 623 MW 10-hour pumped hydro energy storage capacity respectively with the future opportunity for integrated wind farms.

- In April 2025, the Scottish Government approved UK’s pumped storage hydro project at Loch Earba. This will be the largest pumped hydro storage project, which will have 1800 MW installed energy production capacity and 40,000 MWh storage capacity, surpassing the currently existing storage capacity.

- In March 2025, the Madhya Pradesh, India, government launched a scheme for the development and implementation of pump hydro storage projects in the state in an attempt to tackle the surplus energy available in the state.

- In March 2025, SSE and Gilkes Energy submitted a Section 36 planning consent application to Scottish Government for a proposed joint venture Fearna pumped storage hydro (PSH) project in Scotland’s Highlands. The 50:50 development joint venture project is located at the western end of Glengarry, around 25km west of Invergarry and adjoins SSE Renewables’ existing Loch Quoich reservoir in the Great Glen hydro scheme. Under the terms of the joint venture agreement, Gilkes Energy will lead the project’s development under a developer services agreement with SSE Renewables.

- In January 2025, the provincial government of Ontario, Canada, commenced the pre-development work on a pumped hydro energy storage project, which have a storage capacity of 1G/11GW. Ontario will invest up to CA$285 million (US$198 million) to advance the Ontario Pumped Storage Project, proposed for construction in Meaford, a coastal municipality about 180km from Toronto.

Segments Covered in the Report

By Type

- Open Loop

- Closed Loop

- By Capacity

By Capacity

- Below 500 MW

- 500-1000 MW

- Above 1000 MW

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get Report Sample Link @ https://www.precedenceresearch.com/sample/6295