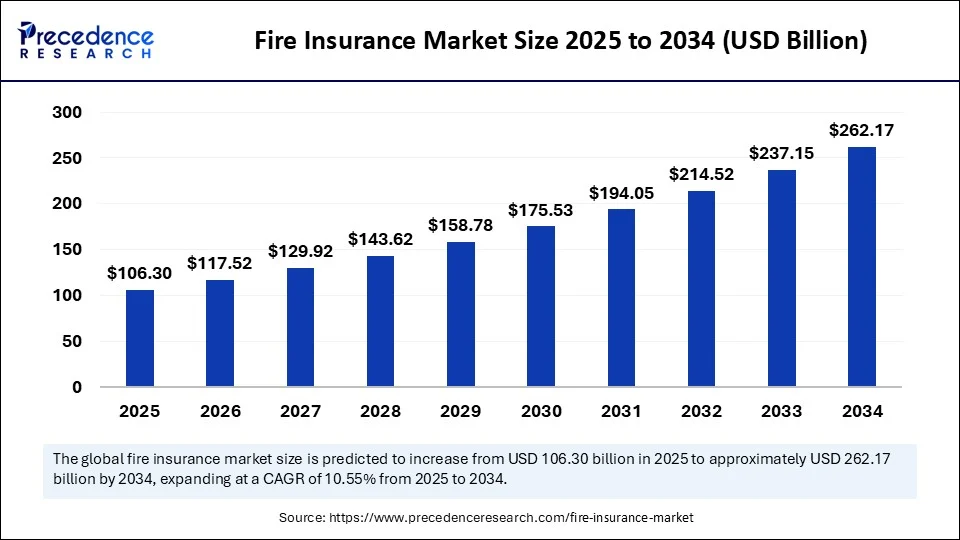

Fire Insurance Market Size to Surpass USD 262.17 Billion by 2034

Fire Insurance Market Key Takeaways

- The global fire insurance market was worth USD 96.16 billion in 2024 and is projected to reach USD 262.17 billion by 2034, growing at a CAGR of 10.55%.

- North America held the highest market share at 41% in 2024.

- The Asia Pacific region is poised for the fastest CAGR growth over the forecast period.

- In terms of coverage type, property fire insurance led the market in 2024.

- The business interruption insurance segment is expected to experience the fastest growth ahead.

- By property type, commercial property insurance accounted for the majority of revenue in 2024.

- Industrial property insurance is forecast to expand at the fastest CAGR in the coming years.

- The annual policy segment held the highest share by policy term in 2024.

- Between 2025 and 2034, multi-year policies are projected to grow most rapidly.

- High-deductible insurance policies led the market in 2024 in terms of deductibility.

- Low-deductible fire insurance is anticipated to be the fastest-growing category in the future.

- By distribution method, brokers held the leading position in 2024.

- The captive agents segment is expected to witness the fastest CAGR during the forecast window.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/6324

AI Impact on the Fire Insurance Market

Artificial intelligence is transforming the fire insurance market by enabling more accurate risk assessment at specific locations using historical data. These advanced insights help insurers calculate precise premiums tailored to individual properties. AI-driven tools streamline the entire claims process—from the initial notification to final settlement—enhancing speed, reducing human involvement, and improving accuracy in claim verification. Fraud detection, a persistent challenge in fire insurance, has also improved significantly through AI-powered systems that identify suspicious patterns and anomalies often missed by human investigators.

Additionally, AI-enabled data analytics allows insurers to extract valuable insights from large data sets, supporting smarter business strategies, product innovation, and refined risk evaluation. These capabilities further support dynamic pricing models, enabling insurers to remain competitive, respond to customer needs effectively, and develop more personalized and efficient insurance offerings.

Market Overview

The fire insurance market is undergoing a strategic evolution as global risk profiles shift due to climate change, industrialization, and digital transformation. Fire insurance has become indispensable for commercial entities, homeowners, and governments looking to safeguard against catastrophic losses. The market is increasingly defined by real-time data analytics, AI-enabled underwriting, and policy customization, responding to consumer demands for faster, more reliable services.

Drivers

Strategic factors driving market growth include escalating wildfire incidents, urban fire risks, and regulatory mandates requiring fire insurance coverage in high-value and high-risk zones. Insurance providers are leveraging big data, geolocation services, and AI models to deliver granular risk assessments and more competitive pricing structures. Digital transformation has improved customer acquisition and retention through better transparency, faster claims settlement, and product personalization. Additionally, the rising global awareness around disaster preparedness is increasing consumer engagement in preventive fire coverage solutions.

Opportunities

New growth pathways are emerging through public-private partnerships aimed at expanding coverage in high-risk and underserved areas. Insurers have the opportunity to integrate their services into broader risk management ecosystems, offering end-to-end solutions that go beyond coverage into prevention and mitigation. AI and machine learning can help in developing behavior-based pricing models, incentivizing customers to adopt fire safety practices. Expansion into rural and semi-urban markets via mobile platforms and agent-assisted digital tools is also a key opportunity. Moreover, innovation in flexible premium structures and instant coverage options can boost consumer adoption across new demographics.

Challenges

Strategically, insurers face challenges in balancing risk exposure with profitability, particularly in wildfire-prone areas. Capacity constraints, particularly during high-claim periods, strain resources and delay settlements. The lack of harmonized insurance standards and data-sharing mechanisms across borders creates inefficiencies for global players. High underwriting costs and limited access to risk data in some markets also affect operational scalability. Customer education remains a barrier, as many individuals and businesses still underestimate the importance of fire insurance until after a disaster strikes.

Regional Insights

North America continues to lead the fire insurance market due to the widespread threat of wildfires and the prevalence of insured assets. In 2024, the region held 41% of the global market share. The Asia Pacific region is forecasted to grow at the fastest CAGR, supported by rapid economic development, urbanization, and increased governmental push for property protection. Europe maintains steady growth through mandatory insurance regulations and strong consumer trust in the insurance ecosystem. Meanwhile, regions like Latin America and the Middle East are witnessing gradual adoption, driven by infrastructure development and policy reform.

Recent Developments

Strategic innovations are shaping the future of fire insurance. In 2025, several insurers partnered with drone and satellite imaging providers to enhance real-time fire detection and loss prevention. Mobile-based microinsurance offerings have expanded access in developing economies. AI-powered platforms for end-to-end claim settlement have reduced claim cycles from weeks to hours. Additionally, insurers are working with urban planners to identify fire-prone zones and adjust coverage accordingly. These advancements mark a shift toward proactive, technology-led fire insurance strategies that align with modern risk management needs.

Fire Insurance Market Companies

- Allstate Insurance Company

- Travelers Companies, Inc.

- Tokio Marine Nichido Fire Insurance Co., Ltd.

- Generali Group

- The Hartford Financial Services Group, Inc.

- Zurich Insurance Group Ltd

- Nationwide Mutual Insurance Company

- State Farm Mutual Automobile Insurance Company

- Ping An Insurance (Group) Company of China, Ltd.

- Munich Reinsurance Company

- Allianz SE

- Farmers Insurance Group of Companies

- Chubb Ltd.

- AXA SA

- Liberty Mutual Insurance Group, Inc.

Segments Covered in the Report

By Coverage Type

- Property Fire Insurance

- Business Interruption Insurance

- Commercial Fire Insurance

- Industrial Fire Insurance

- Residential Fire Insurance

By Property Type

- Commercial Property

- Industrial Property

- Residential Property

By Policy Term

- Annual Policies

- Multi-Year Policies

- Short-Term Policies

By Deductible

- High-Deductible Fire Insurance

- Low-Deductible Fire Insurance

By Distribution Channel

- Brokers

- Captive Agents

- Direct Writers

- Independent Agents

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Perishable Prepared Food Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/