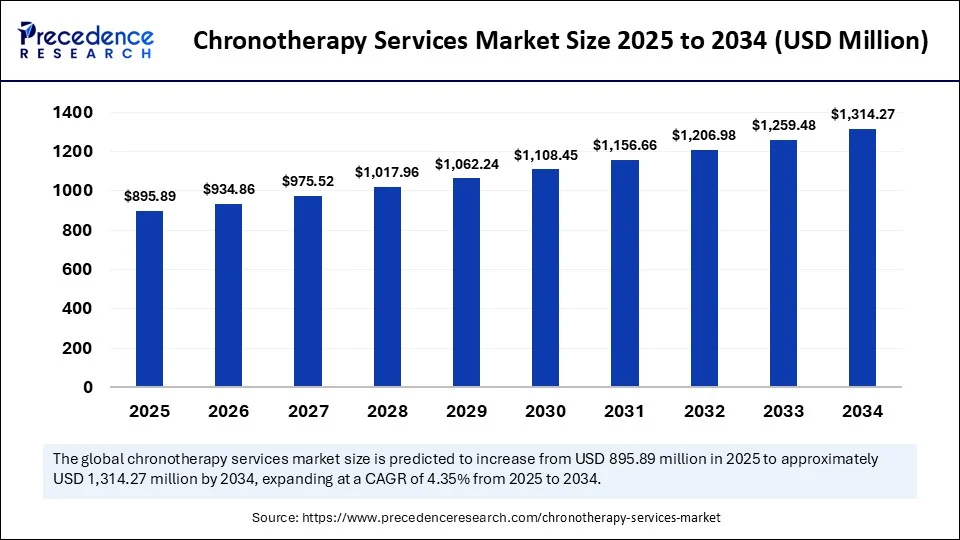

Chronotherapy Services Market to Surpass USD 1,314.27 Million by 2034

The global chronotherapy services market is set to grow from USD 858.54 million in 2024 to USD 1,314.27 million by 2034, registering a CAGR of 4.35%.

Chronotherapy Services Market Key Takeaways

- The chronotherapy services market is on track to reach USD 1.31 billion by 2034, with steady growth fueled by rising demand for time-based therapies.

- While North America leads in revenue share, Asia Pacific presents the strongest growth potential due to expanding healthcare access and innovation.

- The market is heavily driven by sleep disorder treatments and clinic-based services, yet significant opportunities lie in psychiatric therapy applications, home-based delivery models, and pediatric care.

- Growing investments in diagnostic innovation and increased focus on personalized chronotherapy scheduling continue to shape market evolution through the forecast period.

How is AI Integration Transforming the Chronotherapy Services Market?

The integration of artificial intelligence is accelerating innovation in the chronotherapy market by enhancing precision and personalization. AI technologies, including machine learning and predictive analytics, decode complex physiological data to customize interventions based on an individual’s biological rhythms. In drug development, AI improves chronopharmacokinetic modeling and helps identify optimal dosing windows. As healthcare shifts toward precision medicine, AI’s capacity to automate and refine circadian-based care is emerging as a key catalyst for market expansion.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/6328

Market Overview

The chronotherapy services market is witnessing growing adoption due to its ability to improve clinical outcomes by aligning treatments with the body’s circadian rhythms. With increasing scientific validation of time-based therapeutic models and rising public interest in personalized care, chronotherapy is expanding beyond sleep disorders to include psychiatric, metabolic, cardiovascular, and even oncological conditions. As of 2024, the market stood at USD 858.54 million and is expected to cross USD 1,314.27 million by 2034, driven by a compound annual growth rate (CAGR) of 4.35%. This growth reflects broader shifts toward digital healthcare, preventive medicine, and individualized treatment models.

Drivers

Growing demand for precision medicine is the leading driver of the chronotherapy services market. Health systems around the world are investing in technologies that allow real-time patient monitoring, enabling dynamic adjustment of medication timing. The increasing burden of non-communicable diseases, combined with the global rise in mental health disorders, is making time-aligned therapies more relevant. Integration with wearable devices, mobile health apps, and AI platforms provides clinicians with the tools needed to personalize care plans. Simultaneously, the pharmaceutical industry’s growing interest in optimizing drug delivery timing supports broader acceptance of chronotherapeutic strategies.

Opportunities

The convergence of technology, genomics, and patient behavior tracking offers significant opportunities for market expansion. As cloud platforms become more prevalent in healthcare, integrating circadian analytics into electronic health records (EHRs) will enhance care coordination. There is also scope for growth in the pediatric and adolescent segments, where sleep-related issues are rising. Chronic disease management programs in health insurance policies that incorporate chronotherapy modules could create new service delivery models. Innovation in smart pill dispensers, digital reminders, and telemonitoring are expected to create value across both developed and emerging markets.

Challenges

Despite positive momentum, the chronotherapy services market must overcome several challenges. Limited clinical awareness and training in chronobiology restrict widespread adoption, especially in primary care settings. The high cost of diagnostic equipment and specialized software also acts as a barrier in price-sensitive markets. Regulatory frameworks surrounding AI integration in healthcare remain inconsistent across regions, creating entry challenges for new players. Furthermore, patient adherence to timed therapy schedules can be difficult to manage without robust support systems or tech-based reminders.

Regional Insights

North America, particularly the United States, holds the largest market share due to its strong research infrastructure, reimbursement policies, and consumer openness to personalized digital health tools. Europe is home to several pioneering sleep and chronobiology research institutes that have accelerated adoption. Asia Pacific is experiencing rapid growth, supported by expanding middle-class populations, increasing mental health awareness, and investments in digital infrastructure. China and India, in particular, are expected to be key growth engines for chronotherapy services. Latin America and Africa are slowly progressing, although lack of awareness and cost barriers still exist.

Recent Developments

In 2025, notable developments included the launch of AI-integrated chronotherapy platforms capable of synchronizing patient routines with optimal treatment windows. Pharmaceutical companies initiated multi-center trials to evaluate time-specific delivery of antidepressants and metabolic drugs. Sleep clinics in the U.S. and Europe began integrating genomic chronotyping to offer hyper-personalized plans. Healthcare startups received funding to develop consumer-focused apps for managing circadian rhythms, including meal timing, light exposure, and medication alerts. As awareness and access continue to rise, such innovations are expected to drive sustained market acceleration.

Also Read : http://www.expresswebwire.com/pharmaceutical-rapid-microbiology-testing-market/

Chronotherapy Services Market Companies

- Cenegenics

- Chronobiology.com (Swiss BioHealth)

- SleepRate

- Cereset

- Circadia Health

- Nightingale Health

- MindMaze

- Ebb Therapeutics

- The Circadian Sleep Disorders Network

- LumosTech (Lumos Health)

- Chrono Therapeutics

- Pear Therapeutics

- Headspace Health

- ResMed

- Somnology Inc.

- BetterSleep (by Ipnos)

- Emfit Ltd.

- SleepScore Labs

- Nox Health

- Bright Therapeutics

Segments Covered in the Report

By Therapy Area

- Sleep Disorders

- Psychiatric Conditions (e.g., depression, bipolar disorder)

- Oncology (e.g., circadian-timed chemotherapy)

- Hypertension and Cardiovascular Disorders

- Metabolic and Endocrine Disorders (e.g., diabetes, obesity)

- Neurological Conditions (e.g., Alzheimer’s, Parkinson’s)

- Chronopharmacology in Pain Management

By Service Type

- Chronotherapy Scheduling & Optimization Services

- Diagnostic Services (Actigraphy, Salivary Cortisol, Melatonin Profiles)

- Behavioral & Cognitive Chronotherapy Programs

- Light Therapy and Circadian Realignment Programs

- Remote Monitoring & Wearable-Based Services

- Pharmacological Timing Consultations

By Delivery Mode

- Clinic-Based Services

- Home-Based Services

- Telehealth/Virtual Chronotherapy Consultations

- Hospital-Based Services (within oncology or psychiatry departments)

By Patient Type

- Adults (18–65 years)

- Pediatrics and Adolescents

- Geriatric Patients

By End Use

- Sleep Clinics & Chronobiology Specialty Centers

- Hospitals & Academic Medical Centers

- Behavioral Health Clinics

- Home Healthcare Providers

- Corporate Wellness & Occupational Health Programs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/