Aerospace Foam Market Forecasted to Achieve USD 12.78 Billion by 2034

Aerospace Foam Market Size and Forecast 2025 to 2034

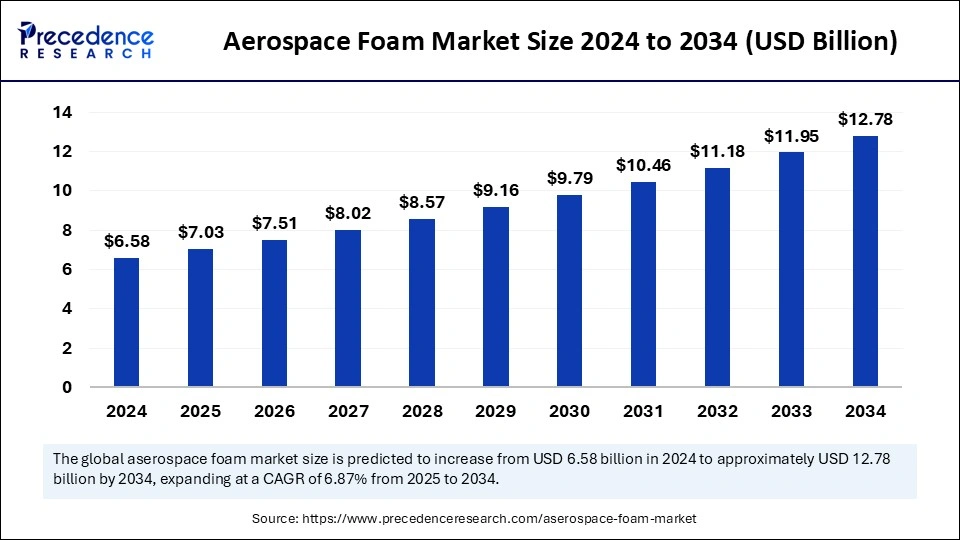

The aerospace foam market, estimated at USD 6.58 billion in 2024, is forecasted to expand to USD 12.78 billion by 2034, driven by a CAGR of 6.87%.

Aerospace Foam Market Key Points

-

North America held the leading market share of 36% in the global aerospace foam industry in 2024.

-

Asia Pacific is expected to witness the highest growth during the forecast period.

-

Polyurethane foam dominated the market in 2024 in terms of foam type.

-

The EPE foam segment is anticipated to register significant growth in the coming years.

-

Carbon walls and ceilings was the top application segment in 2024.

-

Aircraft seats are expected to exhibit solid growth in the application segment over the forecast period.

-

The commercial aviation segment had the highest share in the end-use market in 2024.

-

The military aircraft segment is predicted to experience steady growth in the upcoming years.

Impact of AI on the Aerospace Foam Market

AI is playing a significant role in the aerospace foam market by enhancing the efficiency and performance of foam products used in various applications. One of the primary contributions is in the design and development of advanced foam materials. AI algorithms can analyze vast amounts of data from different materials, operational conditions, and usage scenarios to optimize foam properties such as weight, durability, and insulation performance. This has led to the creation of high-performance foams that are lightweight, yet durable enough to withstand extreme conditions in aerospace environments.

Moreover, AI is also being used for predictive maintenance and quality control. Machine learning models can monitor the production process in real-time, detecting potential defects and deviations from quality standards early on, ensuring consistent product quality. In addition, AI-based systems are helping manufacturers predict foam performance under various operational conditions, contributing to the development of more efficient and safer aerospace applications, including seating, insulation, and soundproofing in both commercial and military aircraft. AI-driven automation in the manufacturing process is reducing production costs, increasing production speeds, and improving overall operational efficiency in the aerospace foam market.

Aerospace Foam Market Overview

The aerospace foam market is a key component of the aerospace industry, offering lightweight and versatile solutions for various applications such as aircraft seating, insulation, and noise reduction. The market includes foams made from materials like polyurethane, polyethylene, and polystyrene, each contributing to enhanced fuel efficiency, passenger comfort, and reduced environmental impact.

As the demand for sustainable and high-performance materials continues to grow, aerospace foams are expected to see significant expansion across commercial, military, and private aviation sectors.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.78 Billion |

| Market Size in 2025 | USD 7.03 Billion |

| Market Size in 2024 | USD 6.58 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.87% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

The growth of the aerospace foam market is largely driven by the increasing demand for lightweight materials to improve fuel efficiency and reduce carbon emissions. As air travel continues to rise globally, airlines and aircraft manufacturers are prioritizing innovations that offer both performance improvements and environmental sustainability. Additionally, the rising demand for enhanced passenger comfort, including better seating materials and reduced cabin noise, is fueling the need for acoustic and cushioning foams in aircraft interiors.

Opportunities

Opportunities in the aerospace foam market are emerging from the growing trend toward electric and hybrid-electric aircraft, which require lighter materials for increased energy efficiency. Another key opportunity is the increasing focus on sustainability within the aerospace industry, driving demand for eco-friendly foam options made from renewable resources or designed for easier recycling. Manufacturers are also focusing on developing foams with superior fire resistance, durability, and insulation properties, further broadening the range of applications for aerospace foams.

Challenges

Despite the growth potential, the aerospace foam market faces several challenges. The fluctuating prices of raw materials can hinder manufacturers’ ability to maintain cost-effective production. Additionally, the industry faces stringent regulatory requirements concerning safety, environmental impact, and material performance. The high cost of research and development for new foam technologies, particularly those that meet both safety and environmental standards, can also be a barrier to market growth.

Regional Insights

North America holds the largest share of the aerospace foam market, primarily due to the presence of leading aerospace manufacturers and a strong military aviation sector in the U.S. This region’s investment in aerospace innovations, including the development of advanced materials, supports its dominant position. The Asia Pacific region is expected to experience the fastest growth, driven by increasing air travel demand, expanding infrastructure, and rising investments in both military and commercial aviation. Europe also remains a significant player in the market, where demand for lightweight, fuel-efficient foams is driven by commercial aviation, sustainability initiatives, and regulatory standards.

Recent Developments

- In September 2024, L&L Products released InsituCore foam materials, which serve as the basis for lightweight composite manufacturing processes. The InsituCore technology directs parts to generate their form by producing internal pressure when creating affordable and sustainable aerospace foam solutions.

- In March 2024, Boeing invested USD 110 million in the Espace Aéro Innovation Zone, which led to the creation of an Aerospace Development Centre. The company shows its commitment to aerospace materials technology advancement by investing strategically in aerospace foam together with other advanced aerospace components that improve aerospace performance.

- In March 2024, the collaboration between 3DEO and IHI Aerospace Co., Ltd. started to promote additive manufacturing (AM) technologies in the aerospace sector. Together, they enable IA to enhance its operational capability through the implementation of DfAM design processes.

Aerospace Foam Market Companies

- Boyd Corp.

- Evonik Industries AG

- ERG Aerospace Corp.

- SABIC

- BASF SE

- ZOTEFOAMS PLC

- General Plastics Manufacturing Company

- Solvay

- UFP Technologies, Inc.

- Recticel NV/SA

- NCFI Polyurethanes

- DuPont

- Rogers Corp.

- ARMACELL

Segments Covered in the Report

By Type

- Polyurethane foam

- Polyethylene foam

- Melamine foam

- Metal foam

- Polyimide foam

- Polyethylene terephthalate foam

- Polyvinyl chloride foam

- Specialty high-performance foam

By Application

- Flight deck pads

- Carbon walls and ceilings

- Aircraft seats

- Aircraft floor

- Others

By End-Use

- General aviation

- Commercial aviation

- Military aircraft

- Rotary aircraft

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Also Read: Fabric Filter Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/